Safeguard Major Projects

From Supplier Financial Distress

The smart way to stay ahead of meaningful supplier financial risks, without slowing your team down.

The smart way to stay ahead of meaningful supplier financial risks, without slowing your team down.

When it comes to key projects, every moment counts. Waiting 5-7 days for a report you needed ‘yesterday’ is out of the question. And the last thing you want to do is bury new suppliers in paperwork, only to wind up with an automated report that creates more confusion than clarity.

Due diligence shouldn’t be a roadblock. Since we only collect relevant data for each contract, 95% of CreditSource assessments are delivered within two business days. That means faster insights for you, and a better experience for your suppliers.

As an Australian-owned company, we know how crucial strong supplier relationships are to your organisation. Our financial analysts will help you stay ahead of important risks with specific recommendations that limit your exposure, while fostering closer supplier relationships and providing a clear path forward.

“We used Credit Source to help us assess the financial viability of a construction company being awarded a contract in excess of $20m. Their advice and report were excellent. We used their advice to reduce the risk to us, and even our financiers were impressed with the report. They plan on recommending CreditSource to other customers. Their report was easy to understand, the were available when we need to clarify anything and despite having been an accountant for 25 years, I learnt a lot from using them.”

“Creditsource are vital business partners for all things financial risk on key suppliers for our major contracts. They don’t just provide incisive financial information, they add value and are always happy to translate the detail of financial statements into understandable risk positions. They are always agile and produce reports with due speed and accuracy, and are happy to go above and beyond with their service. No hesitation in recommending the Creditsource group for any supplier risk reporting or analytics across both local and international markets.”

“CreditSource has been an invaluable asset to our organisation in navigating complex financial landscapes. Their expertise and commitment to providing actionable insights on supplier risk have proven to be instrumental in our decision-making processes. Their reports are not just comprehensive but also remarkably insightful. The team at CreditSource move fast and go the extra mile, demonstrating a dedication to our success that is truly commendable. We have full confidence in their capabilities and would highly recommend their supplier risk reporting and monitoring.”

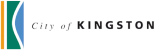

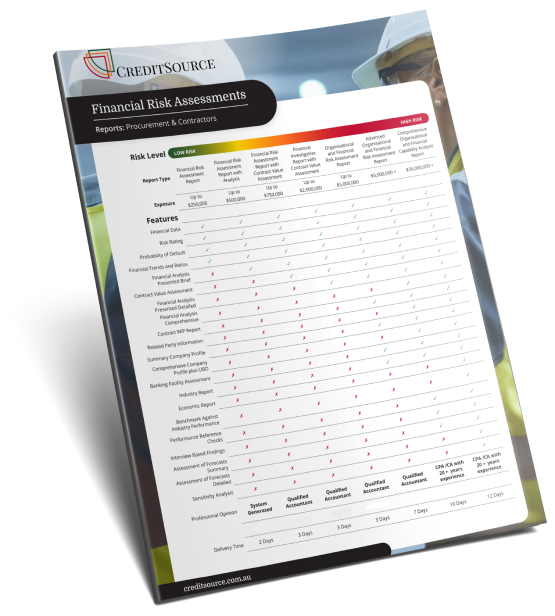

Reduce the time, cost and reputational risk associated with supplier defaults and insolvency. Ensure suppliers and contractors have a suitable financial standing to fulfil contracts and meet warranty obligations. Choose from a variety of report types based on contract value and risk levels.

Ongoing monitoring of supplier and panel members to ensure they remain financially viable across the lifetime of contracts. Track key suppliers in one simple dashboard. Receive alerts if there is a meaningful deterioration in supplier health, click on suppliers for a detailed view, and compare suppliers against industry trends and benchmarks.

Our financial risk reports adopt a standardised presentation format so comparing trading customers and partners to their industry peers is easy. We present financial data using illustrative graphs and tables and, depending on your chosen report, offer written expert analysis that’s succinct and simple to understand.

A simple, easy-to-understand score backed by detailed analysis.

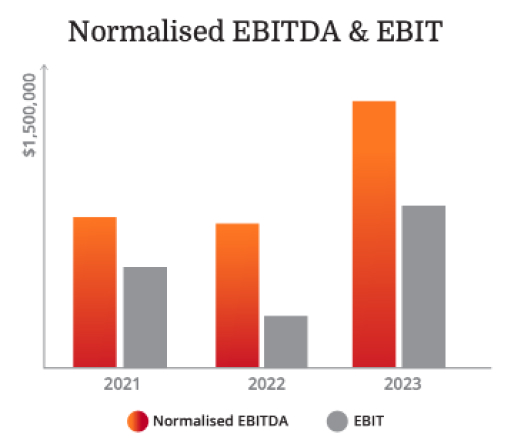

Uncover insights in the context of historical performance.

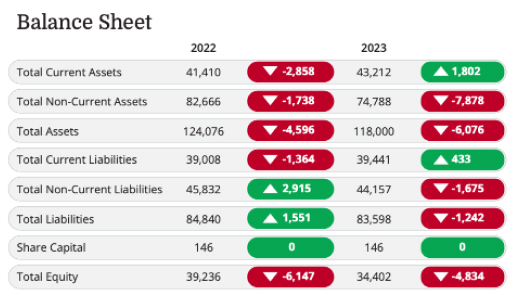

Quickly compare related data points to understand the full picture.

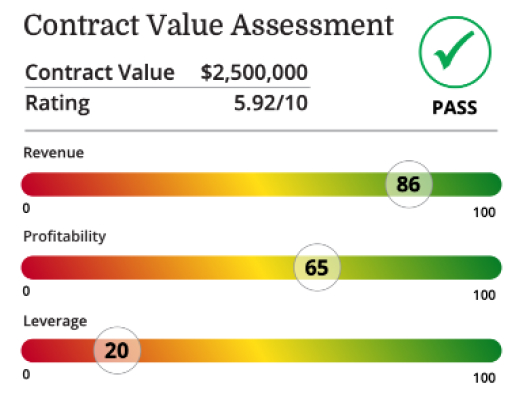

Gauge the appropriateness of the supplier for a specific contract.

One format for simple “apples-to-apples” comparisons.

Accurately predict the future likelihood of financial distress.

CreditSource’s supplier monitoring dashboard makes it easy to navigate volatile industries and manage critical shifts in your supply chain. Our platform alerts you to relevant and meaningful changes in your supplier ecosystem based on your specific contract values, freeing up your team to concentrate on their highest and best use.

CreditorWatch is Australia’s largest commercial credit bureau with 55,000+ customers.

Founded in 2010, CreditorWatch is dedicated to creating innovative credit management tools for small businesses and corporate enterprises.

Visit Website

New Zealand owned CreditWorks has been offering a suite of credit management services to Kiwis since 1998.

The team provides comprehensive company data through a real-time trade debtor credit reporting system.

Visit Website

Creditsafe began in Norway in 1997 and has swiftly expanded to multiple offices across Europe, Asia and the United States.

Creditsafe has over 500,000 customers globally. The group holds commercial credit data on more than 365 million businesses worldwide.

Visit Website

Industry Capability Network (ICN) are experienced industry procurement and supply chain specialists who connect Australian and New Zealand businesses to projects large and small.

ICN provide powerful procurement and supply chain tools, backed by expert advice and support to drive industry capabilities and growth.

Visit WebsiteComplete the form below to find out more and receive a sample of our supplier financial risk assessments.

03 8768 9305Level 1/678 Victoria St,

Richmond VIC 3121

© 2023 CREDITSOURCE PTY LTD | ALL RIGHTS RESERVED | PRIVACY POLICY